2024 financial results

2024 financial results

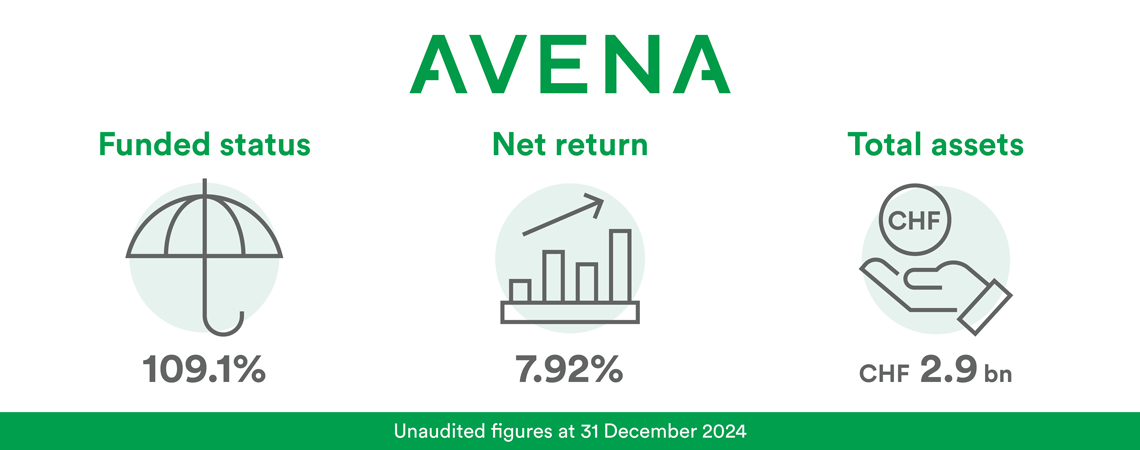

At end-2024, AVENA’s funded status was 109.1% (unaudited) and its net return was 7.92%.

The Fund’s total assets stood at CHF 2.9bn.

2024 financial results

At end-2024, AVENA’s funded status was 109.1% (unaudited) and its net return was 7.92%.

The Fund’s total assets stood at CHF 2.9bn.

AVENA’s Pension Board has decided to pay an interest rate of 3.25% on all savings capital for 2024. That’s the maximum percentage permitted by law, and it brings our funded status to an estimated 109.4%.

This level of remuneration is significantly higher than the legal minimum (1.25%), and our insured members will see the boost in their retirement savings.

The annual interest paid by the Fund is just the tip of the iceberg – it’s the most visible result of a series of measures underpinning AVENA’s ongoing solidity.

The Pension Board is unanimous in its belief that this strategy will produce better long-term results while safeguarding the Fund’s future.

Have a look at our 2023 Annual Report.

What’s inside:

Enjoy!

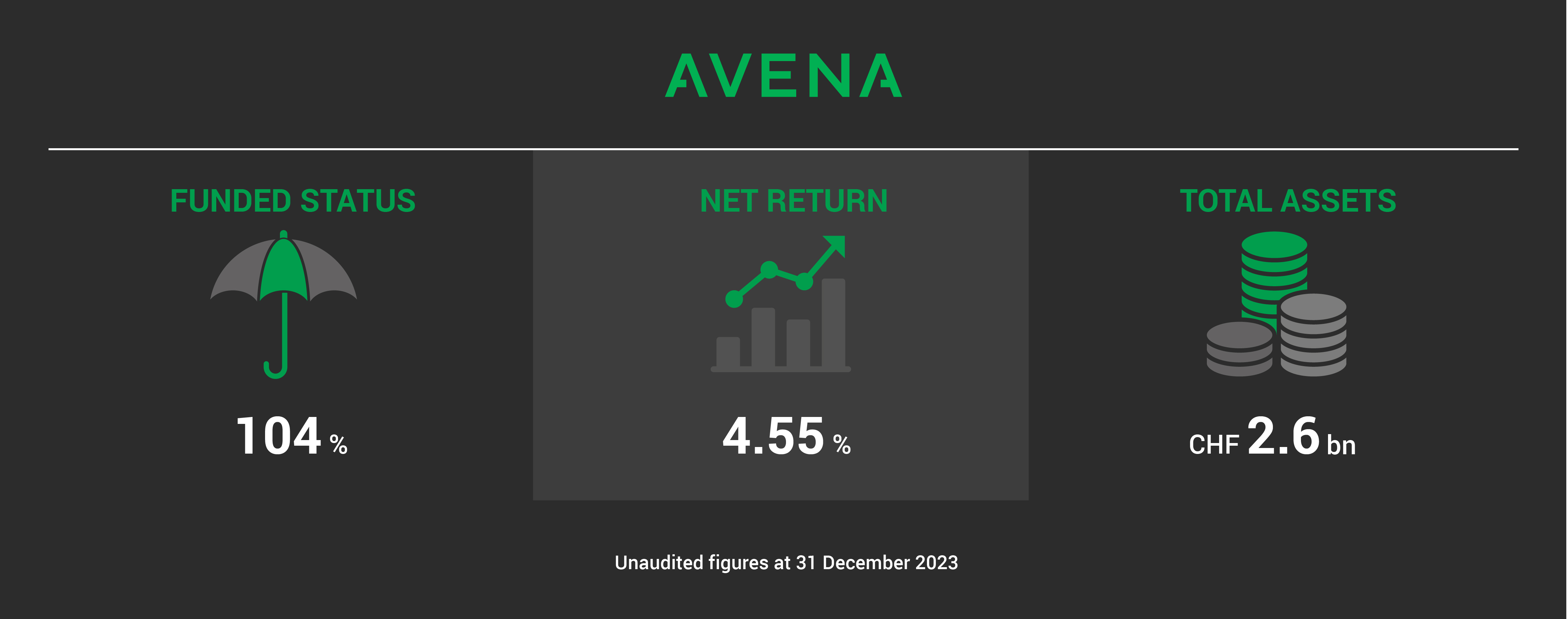

2023 financial results

At end-2023, AVENA’s funded status was 104% (unaudited) and its net return was 4.55%.

The Fund’s total assets stood at CHF 2.627bn.

AVENA's funded status is over 100%.

Dear Fund member,

On 21 September 2023, the votes for the Pension Board elections were counted.

We are pleased to announce the newly elected members of the AVENA Pension Board for the 2024–2028 term:

|

Dominique Blanchard VCT Vector Gestion SA Director |

|

Giovanni Chiusano Fiduciaire Fidinter SA Executive-director |

|

Yvan Henzer Libra Law SA Executive |

|

Alexandre Pahud Fondation Michel Torche Secretary-General |

|

François Pugliese ELITE SA CEO |

|

Catherine Vogt Hesperia SA CEO |

|

Bruno Chappuis European Broadcasting Union Senior Sports Rights Manager |

|

Cosette Hausammann Protocol SA Head of Finance and Administration |

|

Claudine Eveline Imhof Proactif ouvertures Formation Sàrl Joint Head of Digital Training |

|

Claude Rey FidAlp Audit SA Swiss Certified Fiduciary Advisor |

|

Sylvain Rochat Hervest Fiduciaire SA Director / Certified Tax Expert |

|

Delphine Saleres-Deney Garden Center Schilliger SA CFO |

The new Pension Board was presented at the Fund’s Biennial Conference, which was held at the Olympic Museum in Lausanne on 4 October 2023.

We wish them every success in the coming term.

We invite yout to discover the Foudation's 2022 annual report.

Table of contents

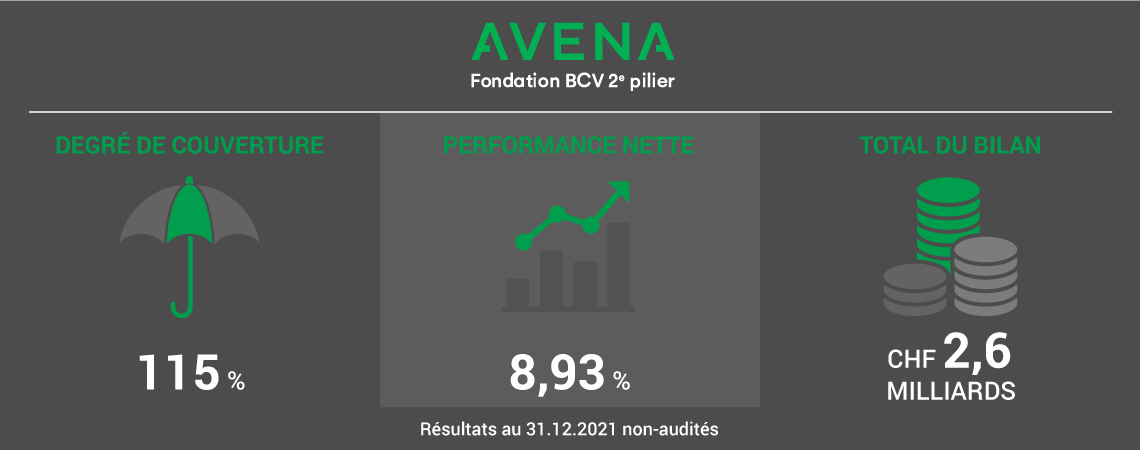

Avena a obtenu d'excellents résultats financiers en 2021.

La stratégie de placement appliquée ces dernières années a fait ses preuves, avec une performance nette de 8.93%.

Le degré de couverture non-audité est quant à lui de 115%.

Ces résultats pérennisent la Fondation et porte son bilan à CHF 2.6 milliards.

Rémunération des capitaux d'épargne

Le Conseil de fondation d'Avena a décidé de rémunérer les capitaux d'épargne obligatoires et sur-obligatoires à hauteur de 1,75% en 2020, soit 0,75% supérieur au taux minimum légal.

La performance de l'année 2020 de 2,28% a permis de renforcer les bases techniques de la Fondation, en provisionnant les montants nécessaires pour une baisse future du taux technique à 1,75%.

Sur les cinq dernières années, Avena a versé un intérêt moyen de 1,875%. Compte tenu de ces éléments, le degré de couverture est estimé à 107,5%.

Grâce à une stratégie de placement durable, Avena renforce ses réserves et provisions lui permettant de pérenniser la Fondation et répondre ainsi à ses obligations sur plusieurs générations.